Contents:

An important aspect about executing arbitrage as a strategy is that price discrepancies are generally low across markets. Arbitrage can only work to a substantial degree if investors have a significant amount to invest in just a single trade. A clear and straightforward example can illustrate what is arbitrage trading.

In Indian markets, the cash segment stocks trade in the two major exchanges – NSE and BSE . It means you can take advantage of buying the stock in one exchange and selling it in another and bag the difference as profit can be an arbitrage opportunity. However, institutional players and mutual funds asset management companies dominate the market. They have the software that helps them identify arbitraging opportunities and carry out the transactions fast, while a retail investor may struggle to capitalize on the prospect. To understand arbitrage meaning, you should know that it is an investment strategy used by traders.

Long call option + Short Put option = Long synthetic futures position

For example, shares of ABC can be sold on BSE, and the same quantity of ABC shares can be bought on NSE. Market analysts said that the prices will move towards the equilibrium as the stock will correct on BSE and move northwards on NSE, restricting the arbitrage in the compulsive delivery-based buy. The bankers declined to be named as they are not authorized to speak to media.

This signifies that irrespective of direction of markets, the arbitrage will fetch a 13 points difference which is risk free and consistent at all levels of market activity. He decides to buy 10 shares of stock ‘X’ from market ‘A’ and sell them on market ‘B’. Pure arbitrage is possible when there is a difference in exchange rates which leads to pricing discrepancies and a small profit on differences. Trading in “Options” based on recommendations from unauthorised / unregistered investment advisors and influencers. Email and mobile number is mandatory and you must provide the same to your broker for updation in Exchange records.

There are different arbitrage strategies that one can execute in different markets, but these opportunities may not be suitable for every investor profile. Pure arbitrage is the type of arbitrage discussed above, where the buyer simultaneously buys and sells a security in different markets, buying stocks of Company P in Stock Market X and selling them in Stock Market Y for a higher price. For example, buying a stock trading on the New York Stock Exchange and selling it on the Japanese Stock Exchange. Pure arbitrage is also common in the forex market due to price discrepancies in the exchange rates.

- Arbitrage is an investment technique used by traders to earn profit from the price difference of an asset in different markets.

- NBT do not guarantee any assured returns on any investments.

- There is a dearth of companies in India that are listed on the Indian stock exchange as well as foreign stock exchanges.

- Arbitrage opportunities are often short-lived, lasting only a few seconds or minutes.

• If you are looking at arbitrage where futures are involved, you would have to look at the price difference of a stock or commodity between the cash or spot market and the futures contract, as already mentioned. In a time of increased volatility in the market, prices in the spot market can widely vary from the future price, and this difference is called basis. The greater the basis, the greater the opportunity for trading. No worries for refund as the money remains in investor’s account. » Joshi, who has access to both markets, can buy the stock on BSE at Rs. 346 and sell the same stock on NYSE at Rs. 350, thereby making a profit of Rs. 4 on every share transacted. The foreign exchange rate and underlying demand and supply conditions prevailing in both markets create favourable opportunities to carry out arbitrage trading.

Trading Account

The returns can be impressive when multiplied by a high volume, even though pricing variations are often tiny and transient. An arbitrage strategy is just one part, with a professional broker like Share India, you can get lots of trading strategies. Share India lets you trade smartly and equips your trade with top-notch technology. So if you want to invest with experts, then join the Share India platform. You can also use the automated system for arbitrage trading.

A Bull Spread is created by buying a call option with a low exercise price and selling another call option with a higher exercise price (the Z-shaped payoffs of a call bull spread are shown in Exhibit 1). Alternatively, one can also create a bull spread using put options by purchasing one put option while simultaneously selling another put option with a higher strike price. Arbitrage opportunities exist in many forms in the market but trying to take the buying in NSE and selling is BSE is not the right one to take.

A well diversified portfolio, greater flexibility and low correlation with the stock & bond markets help reduce volatility and provide an attractive alternative investment option to look at. However, due to complex investing strategies, higher fee structure, illiquidity and lack of information; there is still a long way to go for it. Sebi is trying to level the playing field with its latest ruling on AIFs by providing a direct plan option to investors. We interviewed one of the partners of a pure arbitrage firm, operating in Mumbai. The most often-used arbitrage strategy by this arbitrage firm is between cash and carry and reverse cash and carry. Option strategies needed multiple instruments to construct the trades.

Impact of trading APIs on investment patterns and ecosystem opportunities

Macro arbitrage is quite popular among arbitrage traders, especially higher risk players like hedge funds. Arbitrage trading is not just about cash-futures or exchange to exchange trading. To round up, in any cash and carry arbitrage, the moment you lock in your position, your profit is fixed depending upon the arbitrage opportunity.

arbitrage trading in india India group of companies is just acting as distributor/agent of Insurance, Mutual Funds and IPOs. You may please also note that all disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism. VRD Nation is a premier online stock market training institute where we teach by trading live. We are on a mission to make working class people financially independent and get Trading its rightful place as a viable career option. I hope that made sense and don’t forget to check out the video about arbitrage between futures and the cash market. The fourth point is that the arbitrage opportunities stay for a very short period.

But, the 200 points gain in intrinsic value is adjusted against premium paid to long call position. Commonly there are three type software programs available in the market for Arbitrage Traders.Automatic Arbitrage trading software programs. The Investor gets the small profit without any risk by Arbitrage trading. Mostly The Arbitrage Opportunity is available in following Securities.

What is Big Market Data and Roll of Trading API Solutions all about? – The Economic Times

What is Big Market Data and Roll of Trading API Solutions all about?.

Posted: Sun, 19 Mar 2023 07:00:00 GMT [source]

The bottom line is that you sell the shares at a higher price and buy them back at the lower price. Now, pay very close attention to the next few steps because they are very important. The first thing that you have to do is to sell those shares that you bought on the exchange that has a higher price. So I will sell the 100 shares I have in my Zerodha account on NSE, which is offering the higher price of 500 rupees. Lastly, the stock that you pick should be that of a company that is stable and preferably well-known as you don’t want to be buying a stock of any junk company that will go bankrupt the next day. So once you have done their due diligence of picking a stock for arbitrage, you will go to step 3, which is to buy the shares of this stock.

Minimum is 1 and Max of as many as they help in diversification. I prefer 3 – Large Cap, Mid and Small Cap, Commodities fund and if I had to add one more it would be gold related fund. As per point one; Arbitrage in only possible with shares in Account. One who have vast speculation knowledge and less brokerage and high speed connection alone can do arbitration. No you cannot do more than 100 but then if you buy and sell in the same exchange some quantity, that is allowed.

How To Buy Shares Online In India (May 2023) – Forbes

How To Buy Shares Online In India (May .

Posted: Thu, 27 Apr 2023 07:00:00 GMT [source]

First, you have to realize that, for arbitrage trading, your capital gets blocked. That is because at any point in time you need to have the shares of the company in your Demat account or else you cannot do arbitrage trading. So that money that you used for buying the shares of the company is blocked and it’s not earning any interest. Let us say you paid about 100 rupees in charges and hence your net profit will be 3000 rupees. What about the next time you spot another arbitrage opportunity?

However, as the arbitrageurs identify the perfect gap and take advantage of the mispricing which works to move prices back in line with market inefficiency. Likewise, the arbitrage trade is an efficient strategy, when there is a difference between two markets. As a trader buys and sells similar assets the choice is quite narrow.

Alternative Investment Funds: Understand the nuances, before they become mainstream

Now sometimes there’s is an arbitrage opportunity, but there are not enough buyers or sellers to transact the price. So you may execute one side of the trade from one account, but the other side of the trade may still stay pending or may not get executed. So make sure that the stock that you’re picking for arbitrage has enough liquidity. Is part of the IIFL Group, a leading financial services player and a diversified NBFC. The site provides comprehensive and real time information on Indian corporates, sectors, financial markets and economy. On the site we feature industry and political leaders, entrepreneurs, and trend setters.

You can take stock delivery in one exchange and deliver in the other exchange. Arbitrage can be one of the strategies for traders to explore profit-making opportunities while dealing in the stock markets. Relying solely on arbitrage can be risky and may result in losses. Retail investors may find it difficult to explore such opportunities. Hence, they can invest in arbitrage mutual funds if interested in benefiting from this form of trading.

If you see a price difference of few Rupees in both the exchanges does not always mean there is arbitrage. Option price is the composition of intrinsic and extrinsic values. The time value in turn is derived from option Greeks; Delta, Gamma, Vega, Theta and Rho. Option Greeks are instrumental in measuring the sensitivity of option price to the change in the price of underlying security, time till expiration, volatility and interest rates. The trader makes a profit of Rs. 100 per share and makes a total profit of Rs. 1000 on selling 10 shares.

The Big Winners in Musk’s Twitter Deal? Merger Arbitrage Traders – Bloomberg

The Big Winners in Musk’s Twitter Deal? Merger Arbitrage Traders.

Posted: Tue, 04 Oct 2022 07:00:00 GMT [source]

I am not sure but you are asking the same question in different language and first try to do it with few stocks and see it in working. It is not humanly possible and you have to be using the automated software. It is wrong because it has to be BID and ASK price on each of those exchanges. If you are closing each of the positions, you are actually trading in the same script rather than doing an arbitrage.

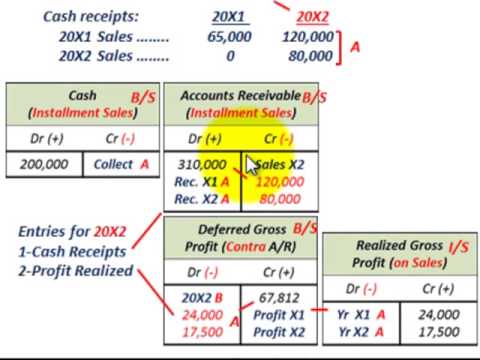

In the above example, assuming that the total transaction cost, of executing the trades and physical delivery of gold, is Rs 200 for 10gm, then the net profit for the trader would reduce to Rs 300. Interest – We assumed interest cost at the rate of 1.5% per month for funding the upfront payment of premium or margin money or proceeds to buy a stock. As shown in Exhibit 3, this strategy gives a riskless profit of Rs 4.6 at any closing stock price. As shown in Exhibit 2, this strategy gives a riskless profit of Rs 1.85 at any closing stock price.

The put-call parity equation states that if one of the asset prices deviates from the relationship, an arbitrage opportunity will arise. This allows traders to exploit the opportunity by buying the underpriced asset and selling the overpriced asset. A trader can sell shares on one stock exchange and then purchase identical shares on another exchange if one already has shares in a free demat account. Therefore, a trader can earn a profit if he sells at a higher price and purchases identical shares at a lower price.